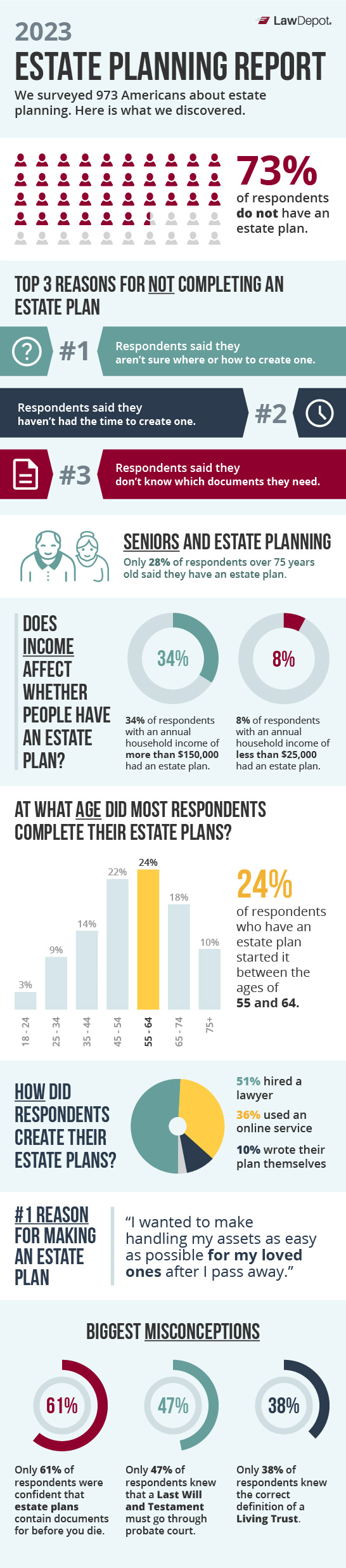

Why don’t you have an estate plan?

- Who has an estate plan

- How well do people actually understand estate documents

- How they made their plan if they have one

- What’s keeping them from making a plan if they don’t have one yet

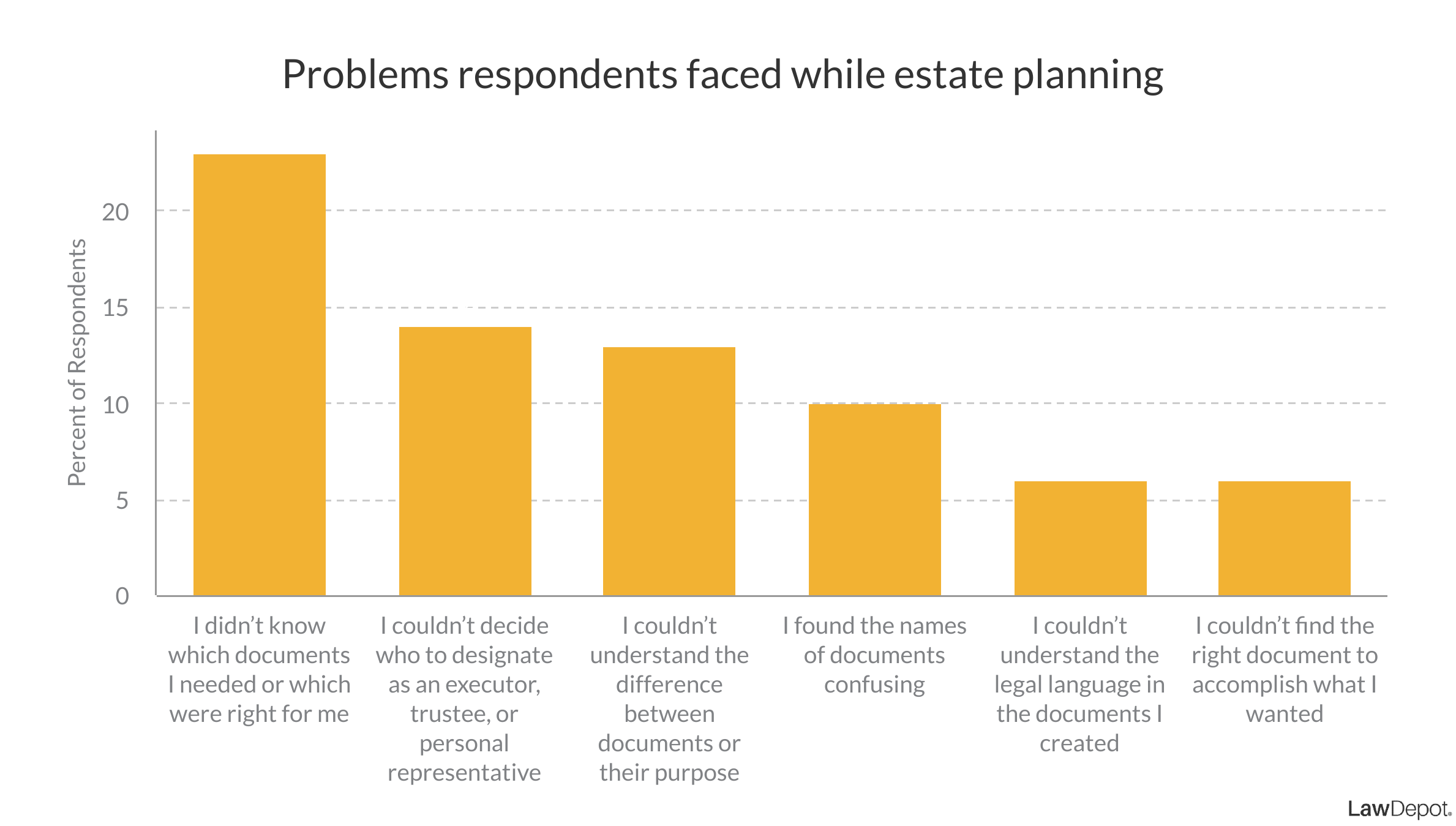

- Which part of estate planning they found the most challenging

- Which documents were the most confusing

What is an estate plan anyways?

Your estate plan is not only for after you die.

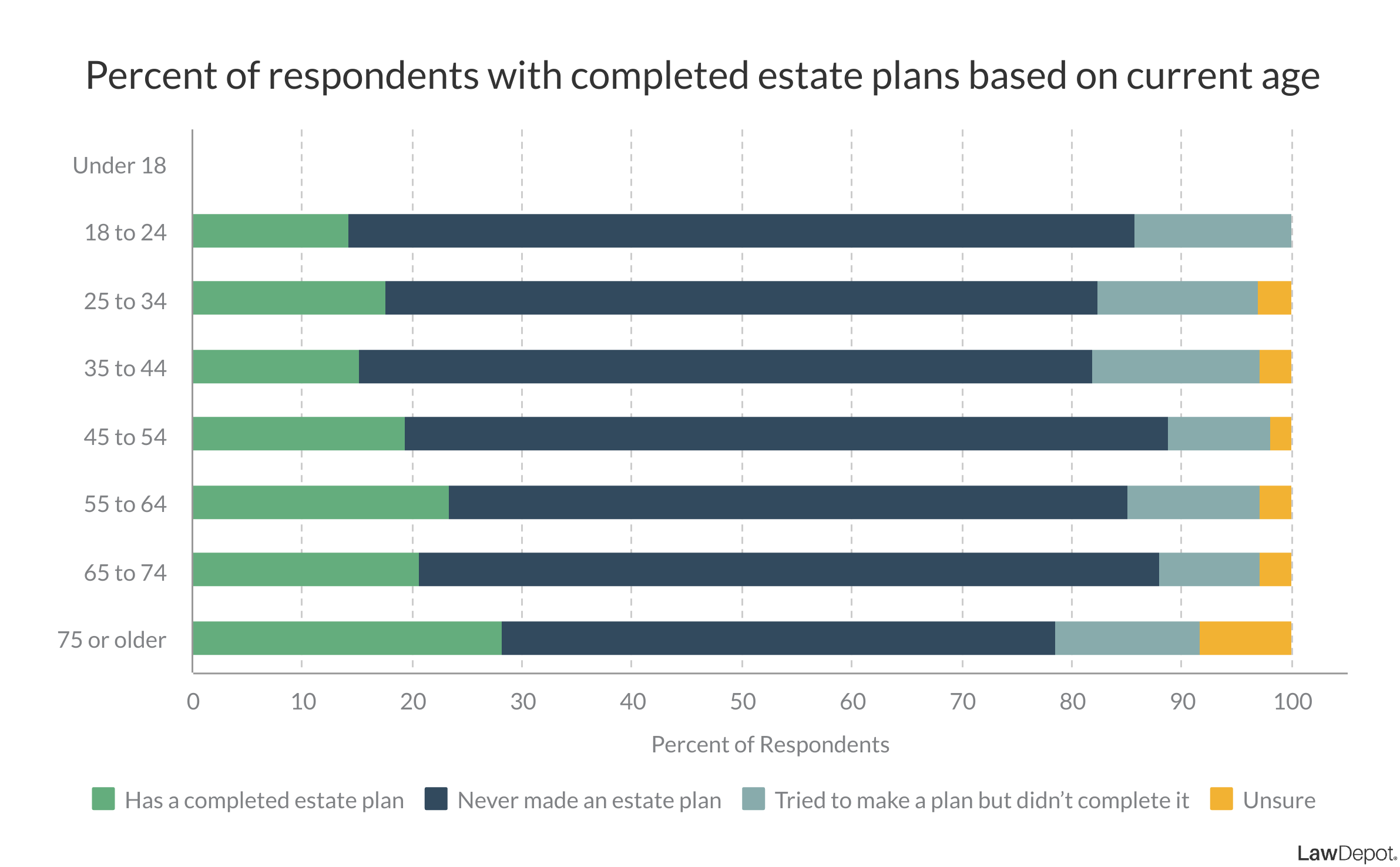

How many Americans have a documented estate plan?

- 23% had a documented estate plan

- 11% tried to create an estate plan but didn’t complete it

- 62% did not have an estate plan

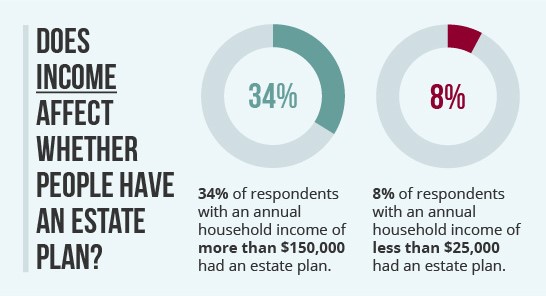

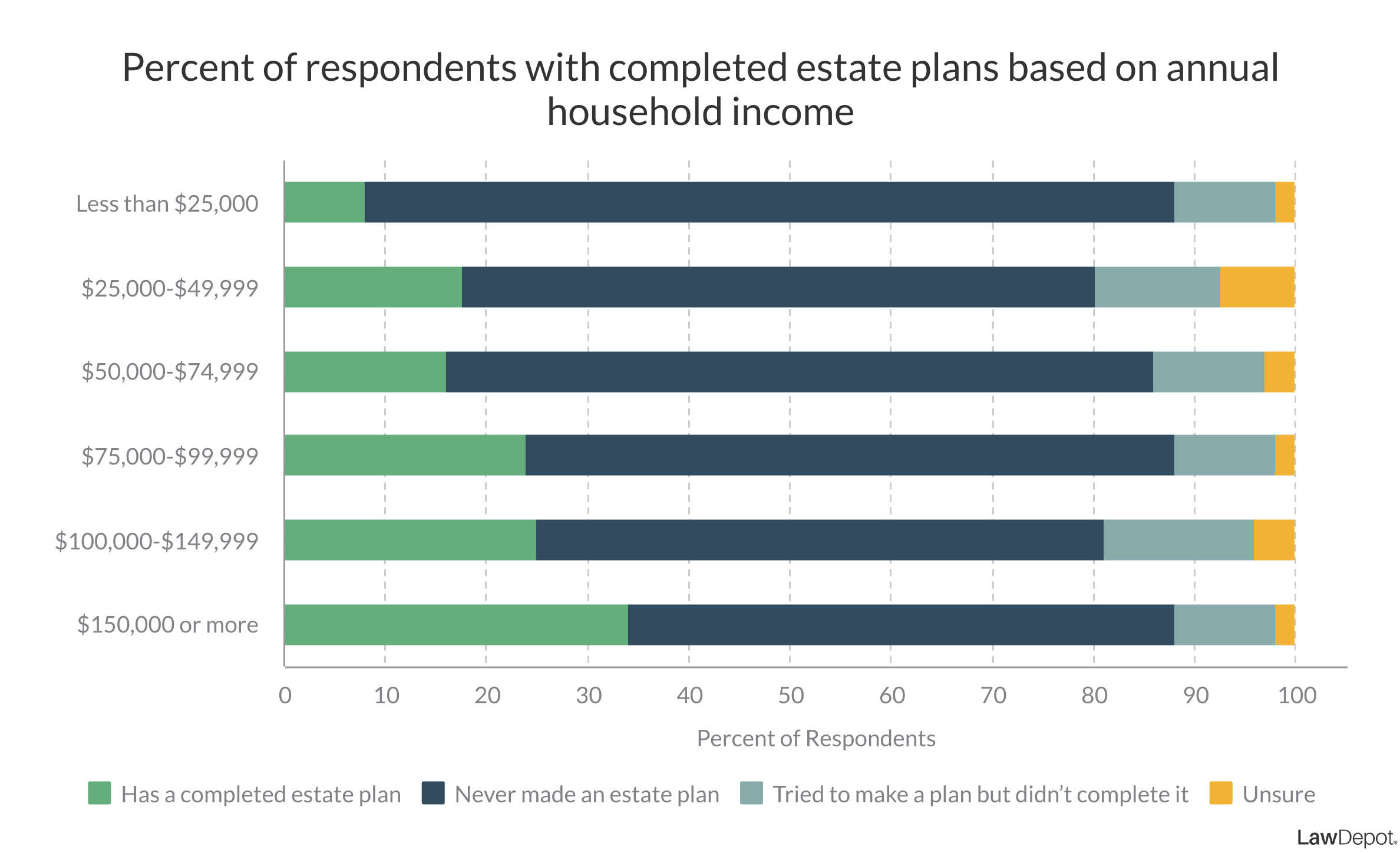

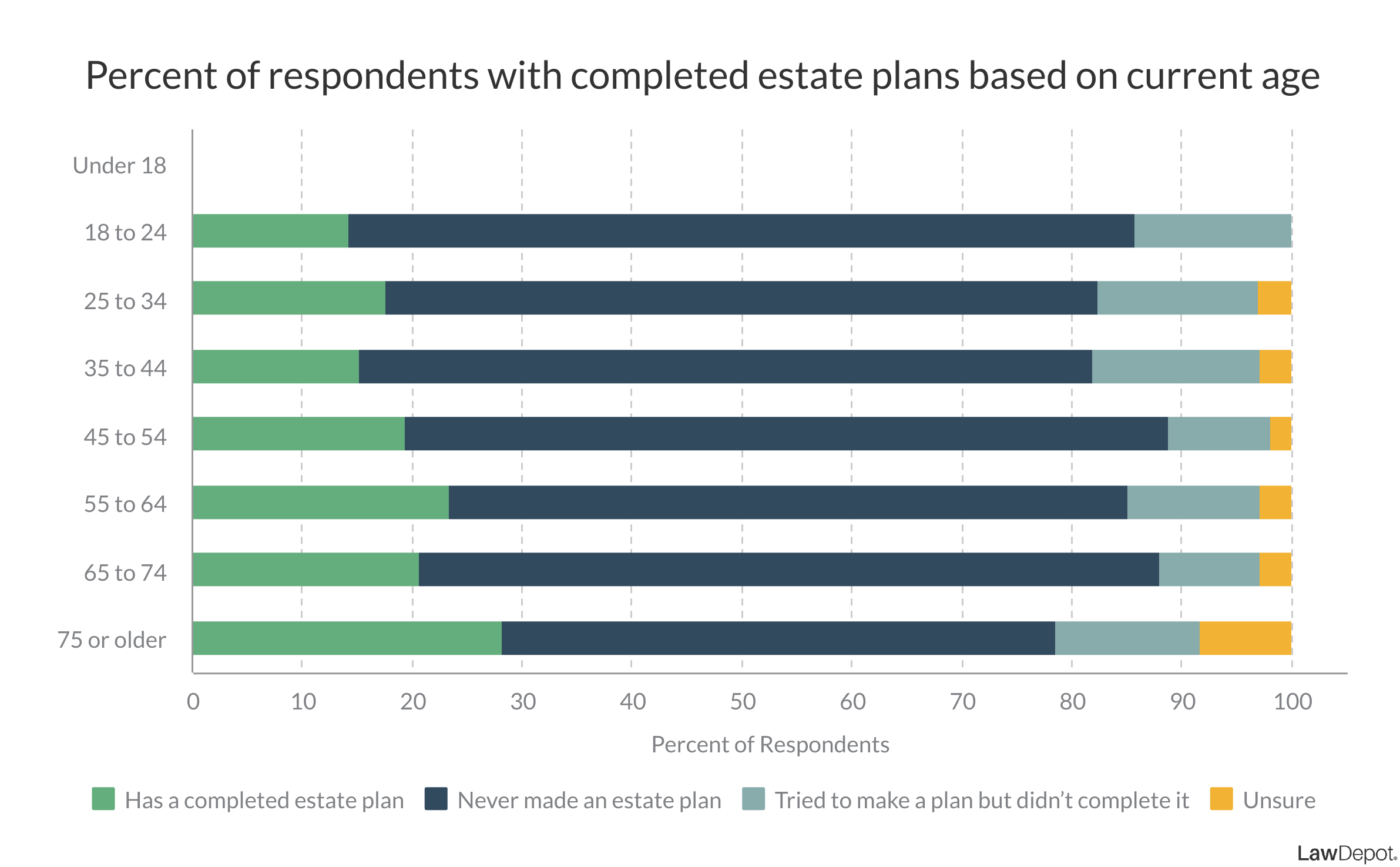

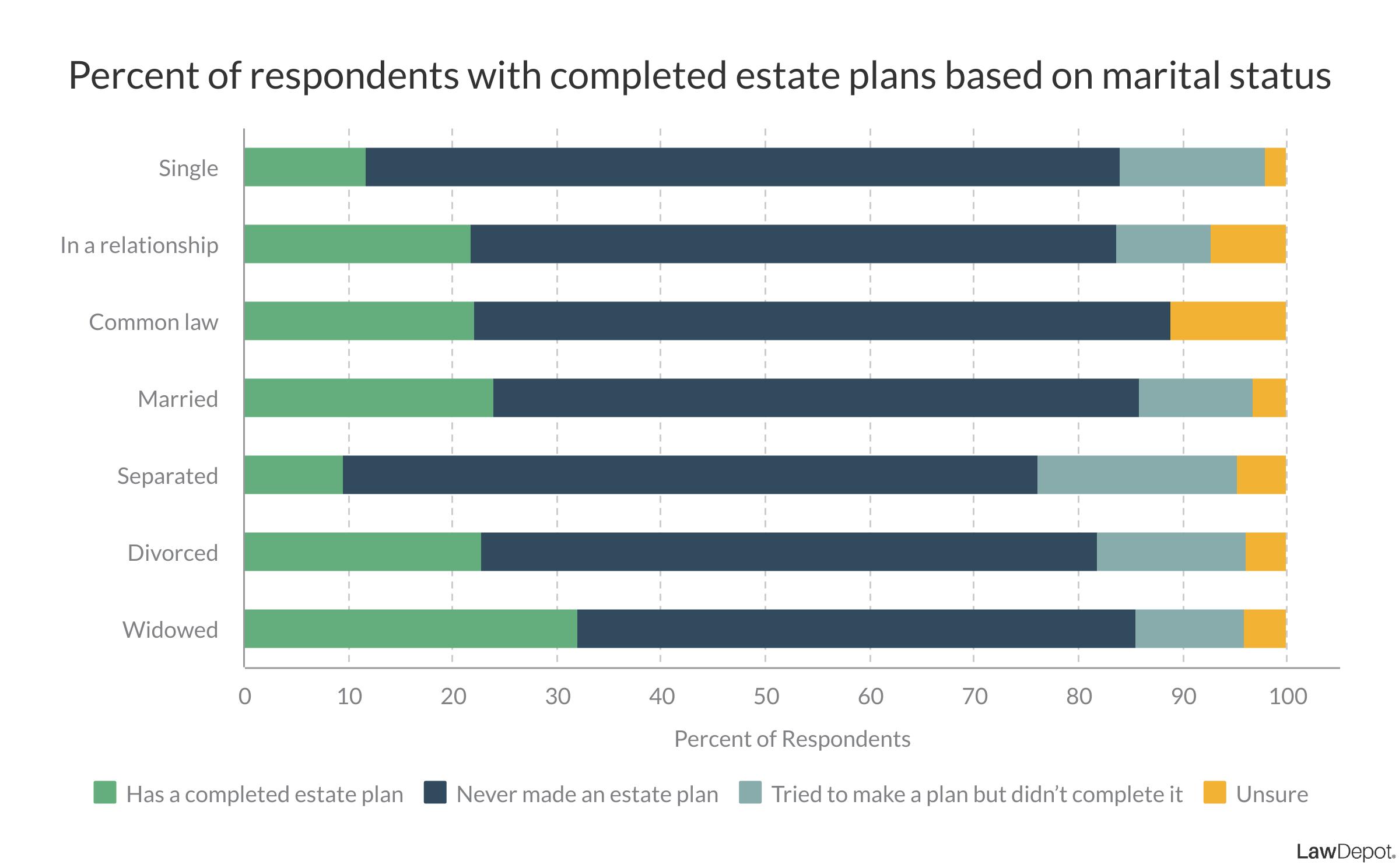

Who has an estate plan?

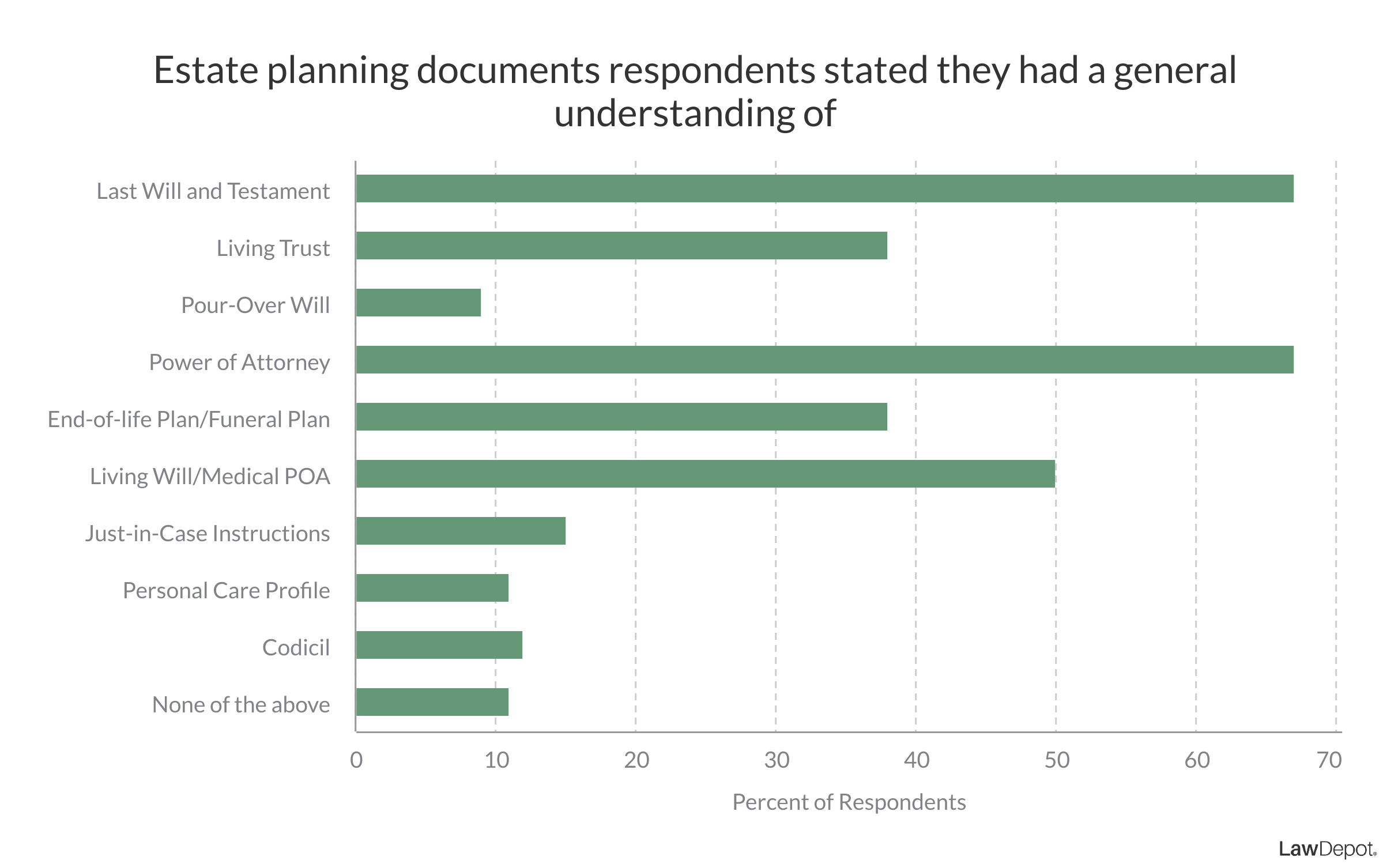

How well do Americans understand estate planning documents?

| Contract | Also known as | Definition | Used |

| Last Will and Testament | Last Will | A legal document that comes into effect after you die and dictates how you want to distribute your estate | When you pass away |

| Living Trust | Grantor Trust | A document that creates a trust (i.e., a legal entity) that holds assets for beneficiaries to inherit eventually. “Living” refers to the fact that the trust is created during your lifetime. There are two main kinds: revocable (i.e., can be changed) and irrevocable (i.e., cannot be changed) | Comes into effect as soon as it’s signed but is used to distribute assets once you pass away |

| Pour-Over Will | A type of Will that works together with a Living Trust. A Pour-Over Will transfers (or pours) any assets not included in your trust at the time of your death into the Living Trust. | When you pass away | |

| Power of Attorney (POA) | This document allows one person to appoint another person to act on their behalf concerning finance, real estate, business, and more. There are two main types: ordinary and durable. | When you become incapacitated or aren’t present to make decisions for yourself | |

| Medical Power of Attorney | This is a specific kind of POA that allows you to grant medical decision-making powers to another person. | When you become incapacitated or cannot make decisions for yourself | |

| Living Will | Advance Directive, Personal Directive, Health Care Directive | Use this document to specify the medical treatments you wish to receive if you become incapacitated and can’t communicate. Many Living Wills include a Medical Power of Attorney. | When you become incapacitated or cannot make decisions for yourself |

| End-of-life Plan | Funeral Plan | This document specifies how you want your body to be dealt with and whether you would like any funeral or memorial services to be held in your name. | When you pass away |

| Codicil | Amendment to Last Will | Use this document to make changes or amendments to an existing Last Will and Testament. This is useful for keeping your estate plan up-to-date. | When you pass away |

| Personal Care Profile | Use this to describe your interests, beliefs, and other personal information to your caregiver if you become ill, lose your mental capacity, or as you age. | When you become incapacitated or are not present to make decisions for yourself | |

| Just-in-Case Instructions | Letter of Last Instructions | Compile your personal, legal, and financial information into a single document for quick reference. These instructions help someone you trust to take care of a wide range of tasks on your behalf. | When you pass away, in the event of an emergency or if you need someone to care for your affairs for an extended period |

Quiz Scores

We quizzed respondents by asking them seven questions related to estate planning documents. Also, we instructed respondents at the beginning of the quiz to choose “unsure” if they were not confident they knew the correct answer.

- Respondents with a completed estate plan scored 70% on average

- Respondents without an estate plan scored 61% on average

- Respondents who tried to make an estate plan scored 64% on average

The Most Correctly Answered Questions

| Area you can grant authority in | Percent of respondents that chose this answer |

| Your real estate | 74% |

| Your business | 63% |

| Your finances | 82% |

| Your family’s care | 40% |

| Your medical care | 65% |

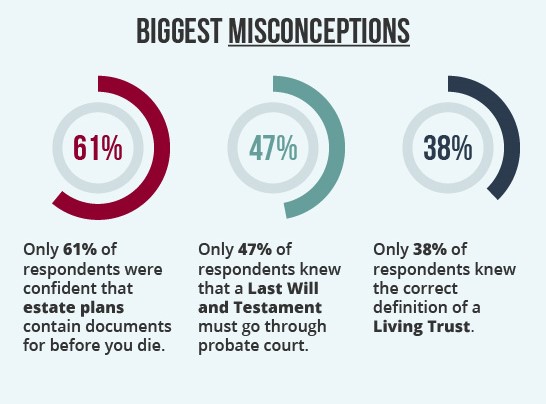

The biggest misconceptions about estate planning

1. Estate plans are only for after you pass away

“Estate plans only contain documents that are useful after you pass away.”

2. Last Wills and Testaments don’t go through probate court

“A legal document that allows you to specify how you want your assets distributed after you pass away.”

- The executor

- The number of beneficiaries

- Debts the creator of the Will had

- Amount of assets

- Type of assets

- If anyone contests the will

3. Living Trusts are overly complicated and only for the wealthy

“A legal document that allows a third party to hold assets on behalf of the beneficiaries and distribute them once you pass away.”

| Reason for choosing a Living Trust | Percent of respondents that chose that a reason |

| “I wanted my beneficiaries/heirs not to have to go through probate court and deal with the associated costs” | 53% |

| ”I wanted to be able to be more specific as to when and how my beneficiaries would receive their inheritance” | 27% |

| “I wanted to minimize estate tax” | 20% |

“It's a common misconception that trusts are only used by the very wealthy. Trusts, on the other hand, can play an essential role in many estate plans. They give you more control over how your assets are distributed and allow you to keep the details of your assets private after your death. Furthermore, trusts can:

-Reduce the taxes owed by your estate and heirs

-Guard your assets against lawsuits and creditors

-Impose conditions on how and when your assets are distributed”

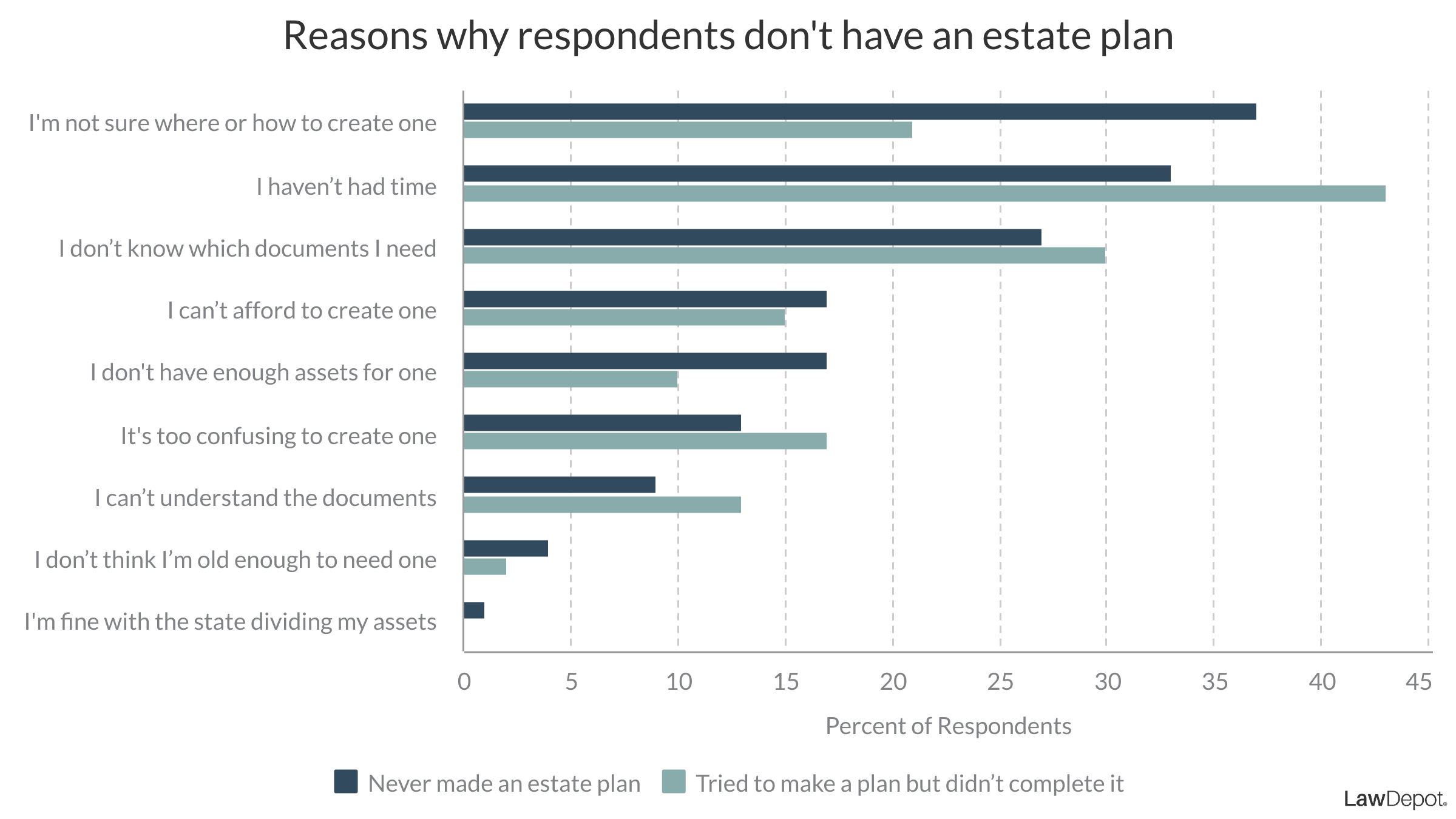

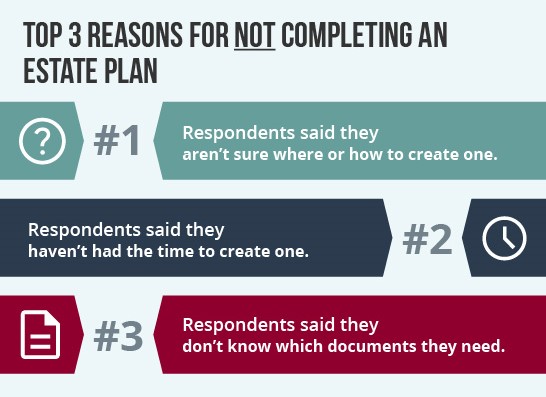

Why don’t you have an estate plan?

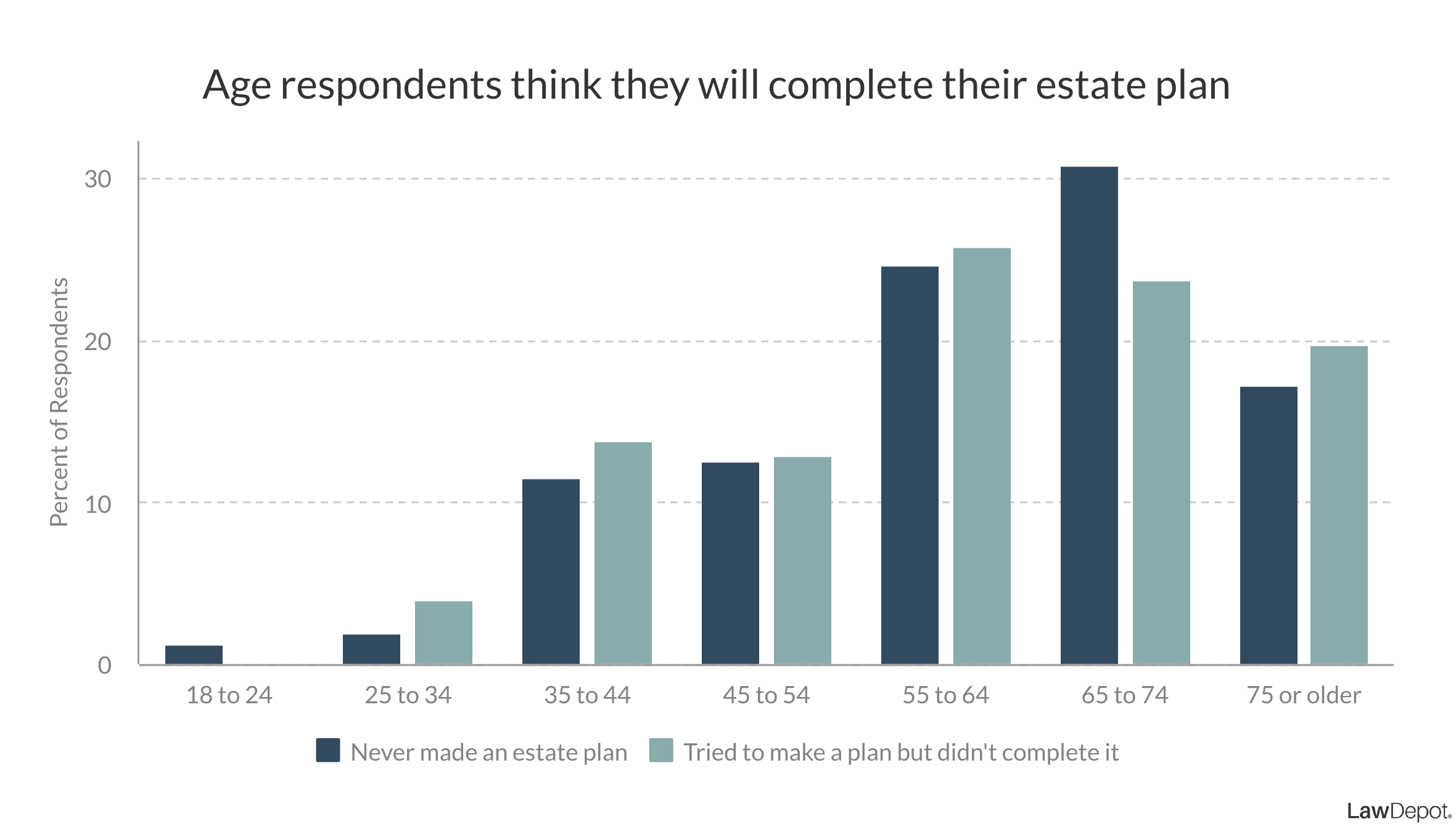

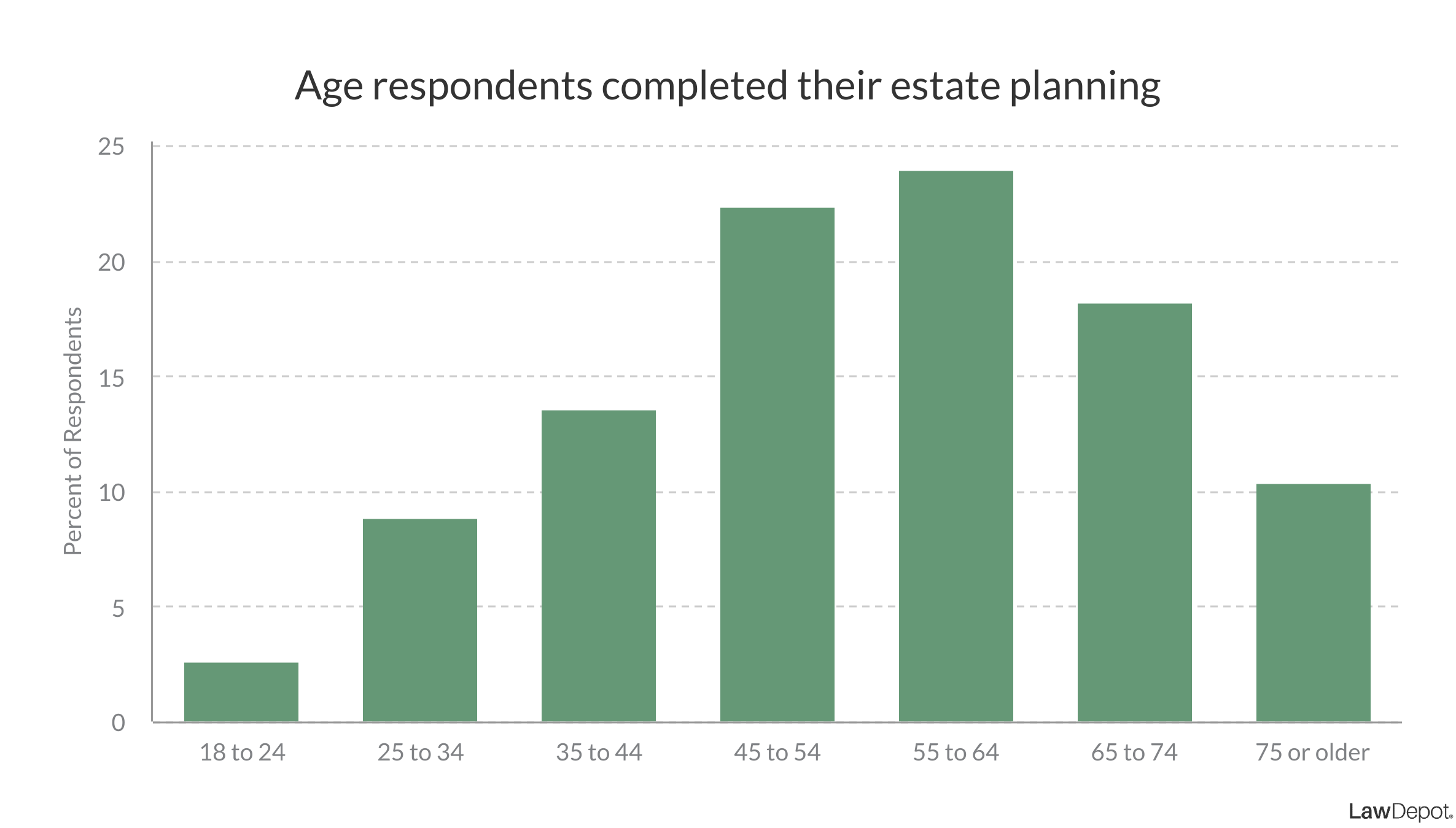

How old should you be to start estate planning?

- They’re not sure where or how to create one

- They haven’t had the time to create one

- They don’t know which documents they need

Where and how do I make an estate plan?

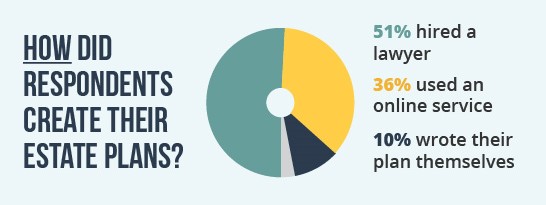

- 51% of respondents created their estate plans with a lawyer.

- 36% of respondents created them using an online service, such as LawDepot.

- 10% of respondents wrote their estate plans by themselves.

Handwrite your estate plan

Consult an expert

“One of the many benefits of working with a knowledgeable attorney is that you don’t have to know which documents you need or how to execute them. A lawyer can guide you and ensure that all your bases are covered.”

Utilize an online legal document service

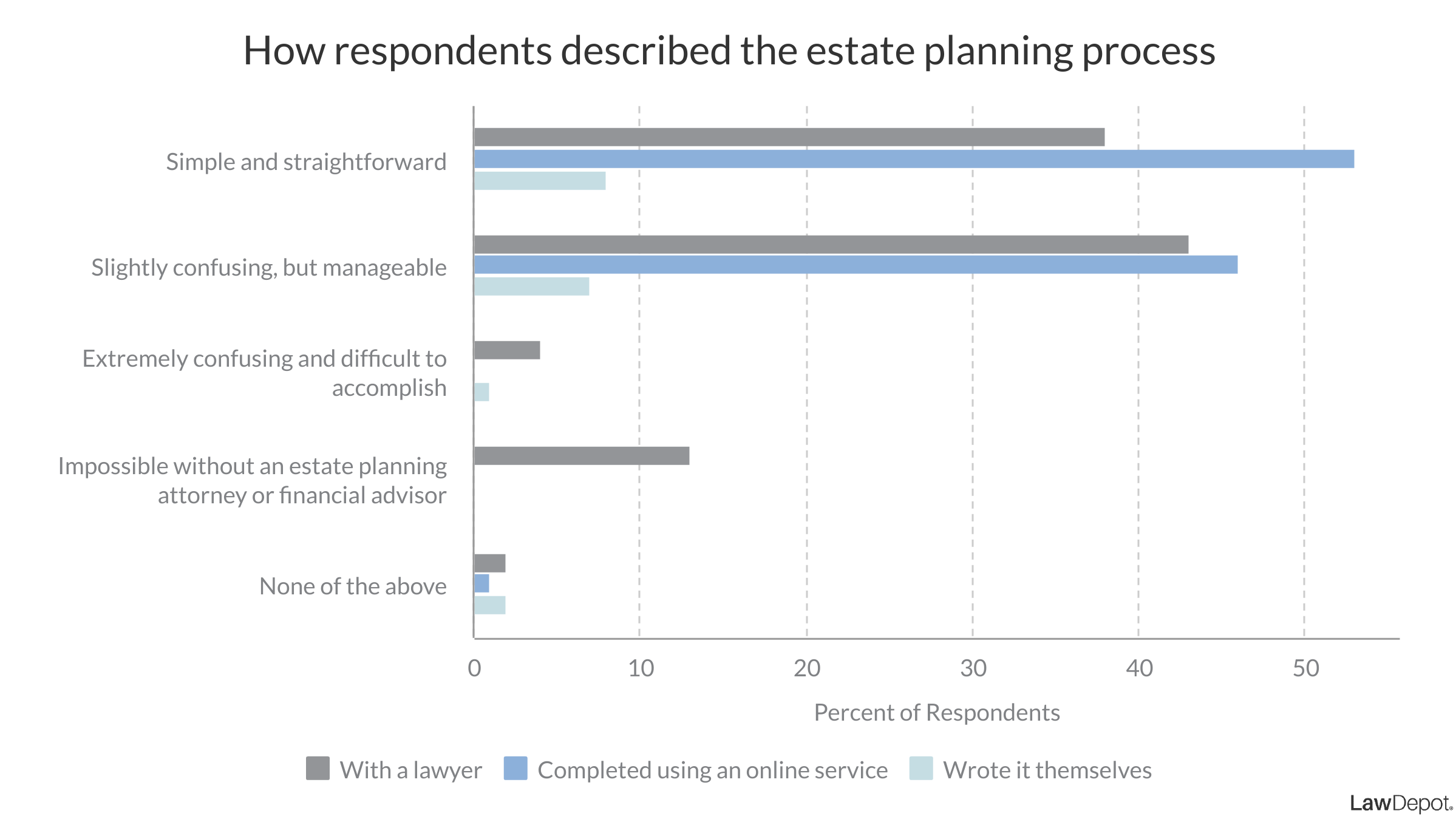

Which is the least confusing method of making an estate plan?

Start your estate planning off easy by making a personal inventory

“A great place to start is to create a simple list of everything that you own, including all of your accounts, your properties, your insurance policies, and retirement accounts, etc. Having all those things [listed] will help you evaluate all you have to protect and prepare to set up a proper plan.”

“First, it gives you an idea of what decisions you need to make and the steps to take going forward. Most estate planning can be done with simple one-page forms provided by the institutions you do business with. Your inventory serves as a checklist of sorts. Second, in the event of your passing, the executor you named knows exactly who to call and how to get in touch with them, saving valuable time and ensuring nothing gets missed.”

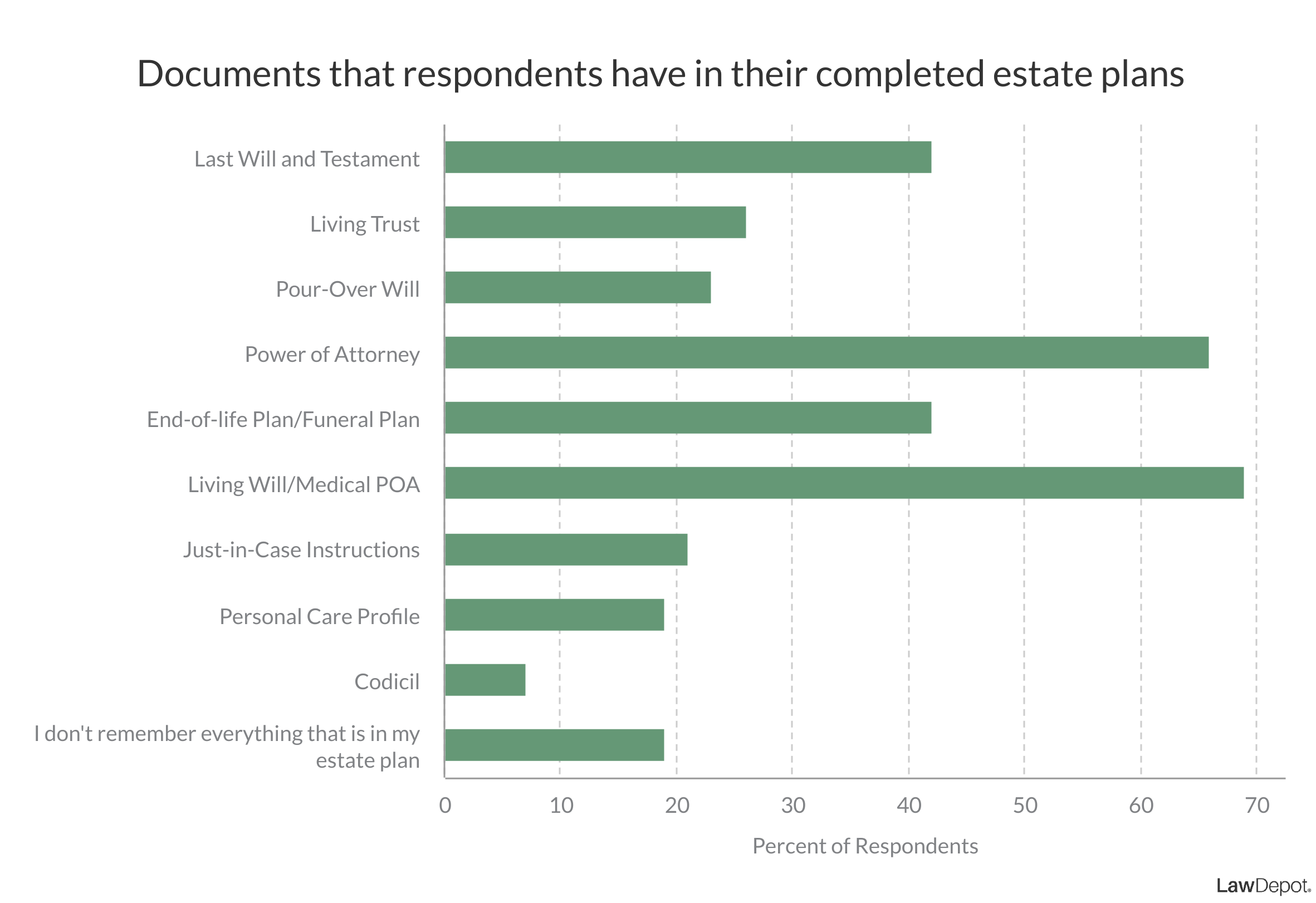

Which estate planning documents do I need?

The estate planning documents you need depend on what you want to accomplish.

Determine your estate planning goals

“When you are working on your plan, communicate with your family and friends about your choices. This not only reduces potential conflict in your estate but could help others create a plan, too.”

Utilize resources and experts to figure out which documents you need

| 'I want to' | Documents you may need |

| Specify what happens to my assets after I pass away | Last Will and Testament or Living Trust and Pour-Over Will |

| Appoint a guardian for any minor children in case I pass away | Last Will and Testament |

| Appoint a caretaker for my pets if I pass away | Last Will and Testament |

| Leave precise instructions for when or how beneficiaries will receive an inheritance | Living Trust or Last Will and Testament |

| Protect my beneficiaries’ inheritances from creditors, or other third-party interests | Living Trust |

| Specify what I’d like done with my remains and any wishes I have for my funeral | End-of-Life Plan |

| Specify my medical wishes in case I become incapacitated or unable to communicate | Living Will |

| Appoint someone to make medical decisions on my behalf in case I become incapacitated or unable to communicate | Medical Power of Attorney |

| Appoint someone to make financial, real estate, and business decisions or dictate care for my family on my behalf when I’m incapacitated or unavailable | Power of Attorney |

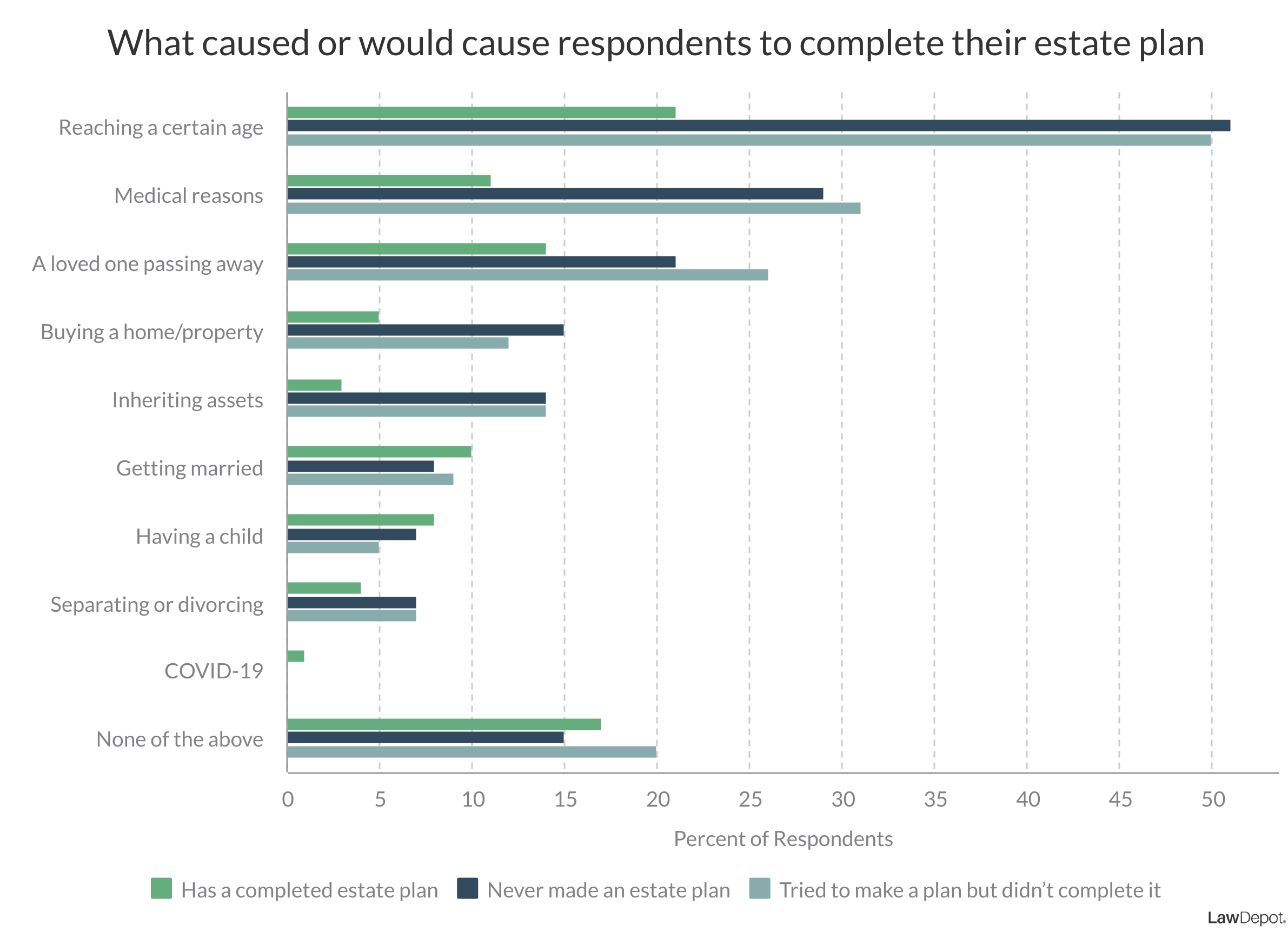

Why should I make an estate plan?

| Reasons why respondents made their estate plan | Percent of respondents that chose that reason |

| I wanted to make handling my assets as easy as possible for my loved ones after I pass away. | 54% |

| I wanted to control how my assets (i.e., money, property, real estate, etc.) were distributed after my death. | 29% |

| I wanted to specify a guardian for my children in case I pass away before they are 18. | 6% |

| I wanted to make sure someone could act on my personal or my business’s behalf if I became incapacitated. | 4% |

| I wanted to make sure my medical treatment wishes were followed if I became seriously ill or unable to decide for myself. | 4% |

| I wanted to specify how I wanted my remains handled or how I wanted my funeral held. | 1% |

“Procrastination and not knowing where to start are always the top reasons people have not created an estate plan. But at the end of the day, those are merely excuses to kick the proverbial can further downfield. Unfortunately, none of these excuses will prevent a tragic car accident or medical emergency. So how do we get from “I’m thinking about it” to “just do it?” You have to create a plan with structure and be disciplined to follow it.”

“If you’re too busy to complete an estate plan, the good news is that you’re alive and well. However, all too often, we see the consequences of delayed action when a client contacts us with a terminal diagnosis or a loved one who has suffered a serious accident. This difficult and challenging time is only made more stressful by tackling estate planning considerations and scrambling to get documents in order. The optimal time to memorialize your wishes is before it becomes urgent.“

“It is undoubtedly tempting to put off creating an estate plan. However, having a well-thought-out plan is well worth the time and money it will take to build. You'll give your loved ones the authority and direction they need to overcome a difficult situation. That way, you can rest assured that you stay prepared if something unexpected occurs.”

- Buying property

- Getting married

- Having a child

- Separating from a spouse

- Divorcing a spouse

- Losing a loved one

“The goal of an estate plan is to ensure your family does not have to sort through a mess after you pass.'

“Most people think estate planning is only for the wealthy, so they give little thought to it. While estate planning can be about reducing the impact of death taxes, it's more about ensuring you have the final say on what happens to your assets instead of the state, banks or family members who may not share your values.”

The 2023 Estate Planning Report Infographic